How Professional Tax Services Can Help with Business Taxes

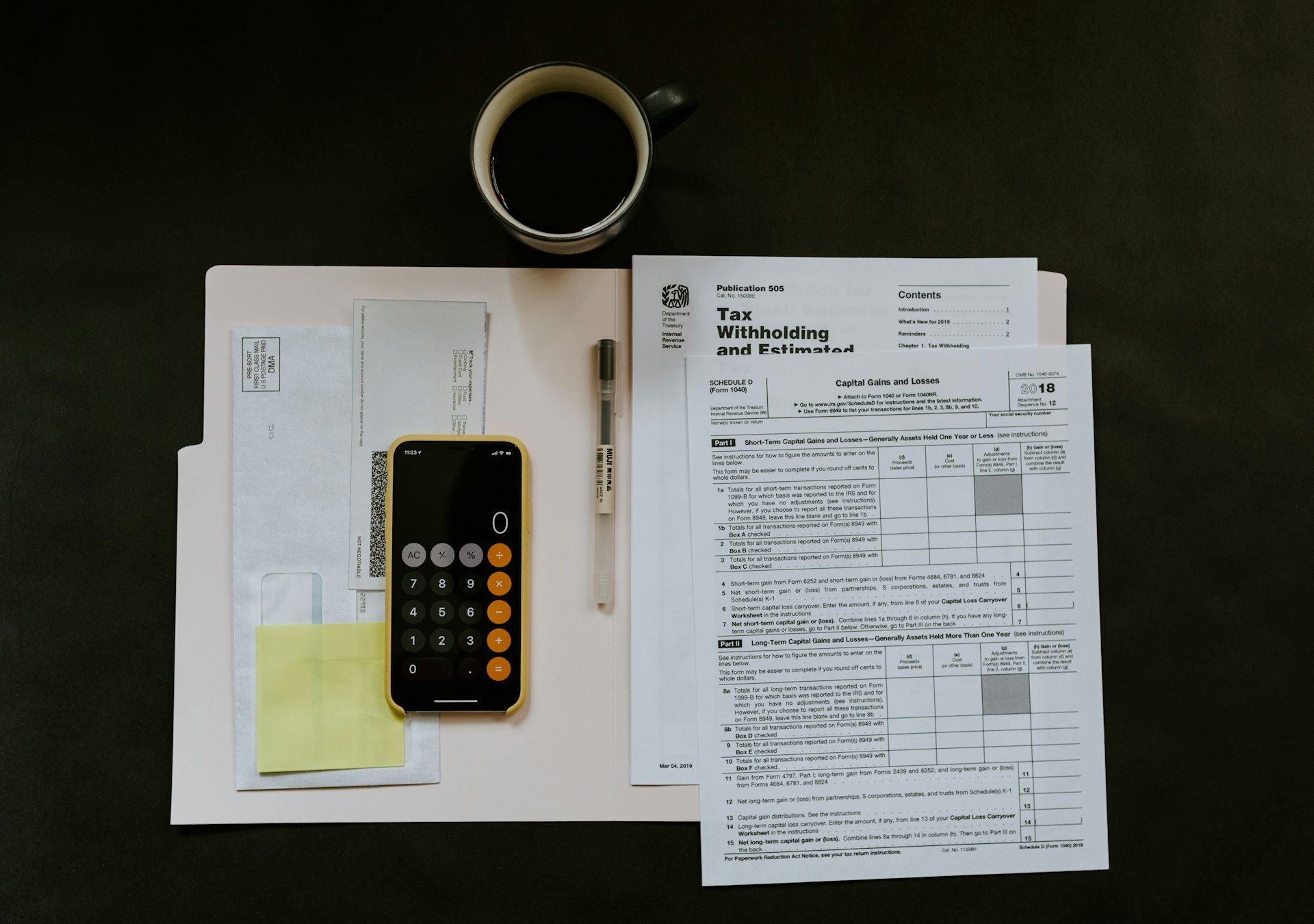

Managing business taxes can be overwhelming, especially for small business owners juggling multiple responsibilities. Between navigating changing tax laws, maximizing deductions, and ensuring compliance, the tax season can quickly become stressful. That’s where professional tax services come in. Hiring an experienced tax accountant or using specialized tax preparation services can simplify the process, save you time, and even increase your potential refund. Let’s explore how professional tax services can make a difference in handling business taxes effectively.

1. Expert Knowledge and Accuracy

Tax laws are constantly changing, and staying updated with the latest regulations can be difficult for business owners. Professional tax preparation experts are trained to understand the complexities of tax codes and ensure that your business remains compliant.

2. Time-Saving and Efficiency

Filing business taxes requires gathering financial statements, tracking expenses, and completing detailed forms — all of which can take up valuable time. Professional tax prep services handle the entire process, allowing you to focus on running your business.

3. Access to Advanced Tax Preparer Software

Professional tax services often use industry-leading tax preparer software that simplifies the filing process and ensures accuracy. These tools can identify potential red flags and recommend ways to increase deductions.

4. Maximizing Deductions and Reducing Liability

A professional tax accountant can identify business expenses and deductions that you may overlook, helping you reduce your overall tax burden.

- Office supplies and equipment

- Employee salaries and benefits

- Business travel expenses

- Marketing and advertising costs

5. Assistance with Business Tax Compliance

Businesses are subject to complex federal, state, and local tax regulations. Failing to meet tax requirements can lead to fines and penalties. Professional tax services ensure that your business meets all filing and reporting obligations.

6. Help with Free Tax Software and Filing Options

While free taxes and free tax software can be appealing, they often lack the level of detail and support that professional services provide. A tax accountant can help you decide whether free filing options meet your business’s needs or if professional support is necessary.

7. Tailored Solutions for Your Business

Every business is different, and professional tax accountants provide customized tax strategies based on your industry, financial situation, and long-term goals.

Why Choose Maximum Taxes Pros for Business Tax Services?

At Maximum Taxes Pros, we specialize in providing expert tax preparation services for businesses of all sizes. Our experienced tax professionals use advanced tax prep tools and industry knowledge to maximize your deductions and minimize your tax burden.

What We Offer:

What We Offer:

Simplify Your Business Taxes Today

Don’t let the stress of business taxes hold you back. Professional tax preparation and tax services can save you time, money, and frustration. Whether you need help with complex returns or want to explore free tax software options, Maximum Taxes Pros has you covered.

FAQ’s

Q1. Why should I hire a professional tax service instead of doing my own taxes?

A: Professional tax services offer expert knowledge, ensure accuracy, help you maximize deductions, and reduce the risk of filing errors or audits. They save you time and can potentially increase your refund.

Q2. How can a tax accountant help with business taxes?

A: A tax accountant can identify eligible deductions, ensure compliance with tax laws, handle complex filings, and provide strategic advice to minimize tax liability.

Q3. Is using tax preparer software enough for business taxes?

A: While tax preparer software can simplify the process, it may not catch all eligible deductions or complex business expenses. Professional tax services provide personalized advice and oversight.

Q4. What’s the difference between tax preparation and tax planning?

A: Tax preparation involves filing your taxes accurately, while tax planning focuses on long-term strategies to reduce future tax liability.

Q5. Can professional tax services help with audits?

A: Yes, experienced tax professionals can represent you during an audit, respond to IRS inquiries, and help resolve any disputes.